Ted Williams (1918-2002) was arguably the greatest hitter in baseball history. He was the last player to break the revered .400 barrier—a remarkable achievement in any era.

How did he do it, and what can we learn from him to improve our decision-making?

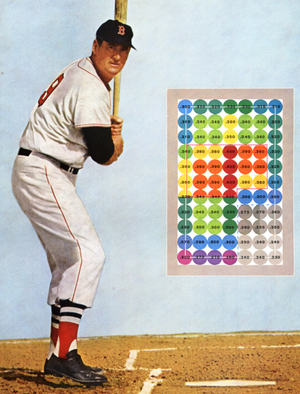

Admittedly, I’m not a diehard baseball fan, but Ted Williams’ book, The Science of Hitting, piqued my interest. It contains a compelling illustration of him at-bat, with the strike zone divided into 77 distinct squares.

Williams recognized that waiting for a pitch in his sweet spot significantly increased his chances of getting a hit. Being patient and waiting for the right opportunity, offered a 40% hit rate. Impatience, on the other hand, could lower his success rate to a mere 23-25%.

Williams understood that average batters turned into great batters if they waited for the right pitch, and even the best batters turned into average ones if they swung at the wrong pitch.

A good hitter can hit a pitch that is over the plate three times better than a great hitter with a questionable ball in a tough spot.

According to baseball legend Rogers Hornsby, the most crucial factor for a hitter is getting a good ball to hit. Williams took this advice to heart, meticulously dividing the strike zone into 77 baseball-sized spaces, and understanding which pitches yielded the highest odds of success for him.

The Zone of Opportunity

We all possess a zone of opportunity, where the odds are in our favor. This is your Circle of Competence, your “sweet spot.”

The most important thing about your circle of competence is knowing where it starts and stops. While simple, it’s not easy. As Richard Feynman once said, “the first principle is that you must not fool yourself, and you are the easiest person to fool.”

A common mistake is to confuse familiarity with understanding. Deep fluency takes a lot of work. If you want to test your understanding of something (or learn something new), try this approach.

“It’s not a competency if you don’t know the edge of it.”

— Charlie munger

Warren Buffett understands sticking to what you understand rather than chasing what’s new and exciting. He writes:

If we have a strength, it is in recognizing when we are well within our cycle of competence and when we are approaching the perimeter. Predicting the long term economics of companies that operate in fast-changing industries is simply far beyond our perimeter. If others claim predictive skills in those industries—and seem to have claims validated by the behaviour of the stock market we neither envy not emulate them. Instead, we just stick with what we understand. If we stray, we will have done so inadvertently, not because we got restless and substituted hope for rationality.

Unlike Williams, Buffett can’t be called “out” on strikes if he resists pitches that are barely in the strike zone. He can, quite literally, wait for the perfect pitch—looking at thousands of different investments before finding one that is just right.

If straying from our core competence decreases our success rate, what can we do to improve our odds?

When you are operating outside of your area of understanding, focusing on positioning rather than predicting is crucial. Two ways to achieve this are by increasing the margin of safety and ensuring circumstances don’t force us into a bad decision.

By learning from Ted Williams and understanding our Circle of Competence, we can make better decisions and increase our odds of success in various domains.